New Delhi: Asserting that the GST had serious "birth defects" which became only worse over the last five years, the Congress on Friday said the GST laws and the manner of their implementation have "wrecked the economy" and the party will work toward its replacement by GST 2.0. The Opposition party said demonetisation was the first "Tughlaqi farman" of the government while the Goods and Service Tax second that harmed the economy.

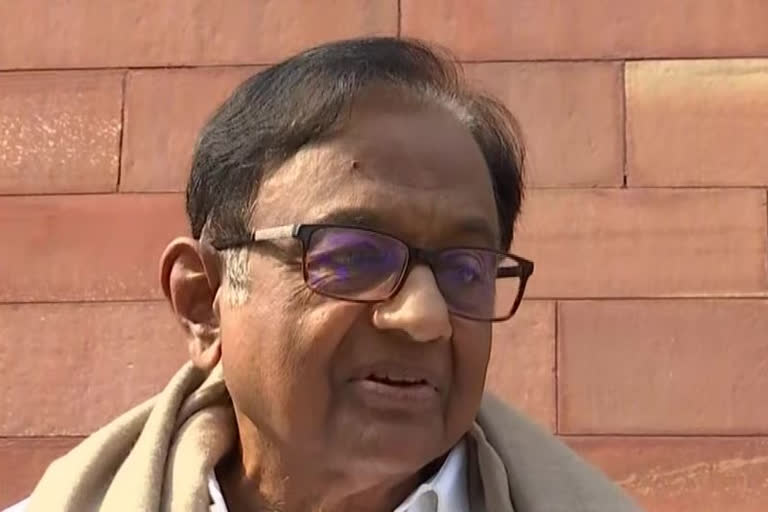

At a press conference here, senior Congress leader P Chidambaram said the GST "celebrates" its fifth birthday on Friday but there is nothing really to celebrate. "The GST had serious birth defects. In the last five years these defects have only become worse and all those touched by GST have been seriously injured," the former finance minister said.

“Due to serious defects in the GST, common people consuming goods and services were paying exorbitant taxes even knowing why those taxes were imposed on them by the government. The law is so defective that the government in five years has issued 869 notifications, 143 circulars and 38 orders. That is a change every 2nd day! This is a GST that is flawed, defective and unstable” he added.

There are six rates in the GST currently— 0.25, 3, 5, 12, 18 and 28%. Besides, there are zero-rated and exempted goods. Congress party promised to bring GST 2.0 if voted to power and the new law will be single rate and low rate. The leaders said that MSMEs have suffered the most because of this tax regime and even the finance ministers of BJP-ruled states are upset with Centre’s approach, he said.

The Congress wishes to make it absolutely clear that the so-called GST that is in force today was not the GST envisaged by the UPA government, he said. "The GST that we have today is a complex web of many rates, conditions, exceptions and exemptions that will leave even an informed taxpayer completely bewildered. Not all registered dealers are informed taxpayers; as a result, they are at the mercy of the tax-collector," he said.

A flawed GST has led to "large-scale destruction" of MSMEs, a sector that contributes up to 90 per cent of the jobs in the manufacturing sector, he said. The worst consequence of the GST brought in by the government has been a complete breakdown of trust between the Centre and states, he said. "As far as the Congress Party is concerned, we reject the current GST and, as promised in the Election Manifesto of 2019, we will work toward the replacement of the current GST by GST 2.0 that will be single, low-rate," Chidambaram said. (PTI)