New Delhi: The outbreak of Covid-19 global pandemic, which has killed nearly 3 million people worldwide, failed to dampen the sentiments of Indian investors as investment in both public issues and rights issues was higher in comparison with previous fiscal, showed the latest data released by the ministry of finance on Wednesday.

While the amount of funds raised through public offers, including IPOs and FPOs more than doubled last year, the number of unique mutual fund investors also increased by 10% despite the adverse economic impact of the pandemic.

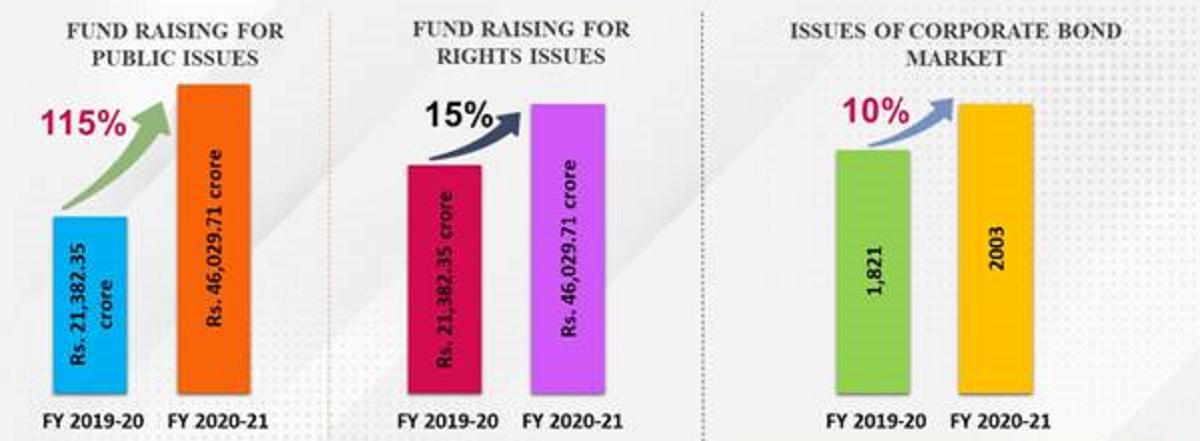

In the last fiscal, companies raised over Rs 46,000 crore through public issues, including initial public offerings (IPOs) and more than Rs 64,000 crore through rights issues. An increase of 115% and 15% respectively, compared to the fund raised during the previous financial year.

In 2019-20, companies had raised only Rs 21,382 crore through public issues and Rs 55,670 crores through the rights issues.

IPOs, FPOs, Rights Issues

An analysis of the data gathered by the ministry of finance showed that in FY 2019-20 the companies raised Rs 21,382.35 crores through 60 initial public offerings (Rs 21,345.11 crore) and two follow-on public offerings (FPOs Rs 37.24 crore).

However, in FY 2020-21, the companies raised Rs 46,029.71 crores, Rs 31,029.71 crores through 55 initial public offerings and Rs 15,000 crores through 1 follow-on public offer (FPO).

Read More: Govt not going for lockdowns in big way, says Sitharaman amid COVID wave

While in 2019-20, companies raised Rs 55,669.79 through 17 rights issues, the amount raised through 21 rights issues in FY 2020-21 increased by 15% to Rs 64,058.61 crores.

In all, companies raised Rs 1,10,088.32 crores in the last fiscal through 55 IPOs, 1 FPO and 21 rights issues, an increase of Rs 33,036 crore (43% more than the previous fiscal).

In FY 2019-20, companies raised Rs 77,052 crores through 60 IPOs, 2 FPOs, and 17 rights issues.

Corporate bonds shine

The investment in the bond market was even better. In the last fiscal, companies raised a whopping amount of more than Rs 7.82 lakh crore through more than 2,000 corporate bonds issues, an increase of 13.5% in comparison with Rs 6.90 lakh crores raised through 1,821 corporate bonds issues in 2019-20.

Mutual funds market deepens

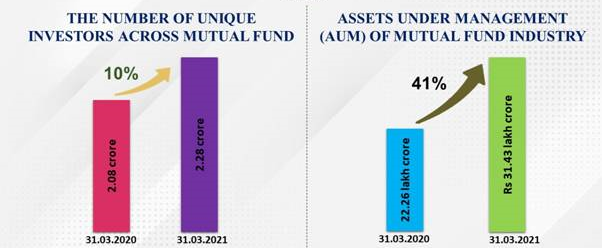

Similar optimism was visible among the mutual funds investors as the number of unique MF investors went up by 10%, from 2.08 crore as on March 31 last year to 2.28 crore unique investors as on March 31 this year.

“Indian capital market has shown its resilience to withstand the ripples caused by exogenous shocks like the pandemic,” said the ministry of finance.

Citing the latest data, the ministry said the assets under management (AUM) of the mutual fund industry increased Rs 22.26 lakh crore in March 2020 to Rs 31.43 lakh crore in March 2021, an increase of 41%.

In a clear proof of increasing penetration of mutual funds to small cities, the asset under management from below the top 30 cities increased from Rs 3.48 lakh crore in March 2020 to more than Rs 5.35 lakh crores in March 2021, an increase of 54%.

The AUM from these cities now accounts for more than 17% of the total assets under management of the mutual fund industry, which has 1,735 mutual funds schemes across categories.

Read More: Infosys announces Rs 15 per share dividend, Rs 1,750 per share buy back plan