New Delhi: On the sidelines of the G7 Finance Ministers’ meeting that concluded in Stresa, Italy, on Saturday, US Treasury Secretary Janet Yellen said that India and China are opposing Pillar 1 of the Organisation for Economic Cooperation and Development (OECD)’s Global Tax Deal.

Speaking to the Reuters news agency, Yellen said that while most countries are with the US on Pillar 1 issues of the OECD’s Global Tax Deal, “we have a problem with India”. “India will not engage with us,” she was quoted as saying.

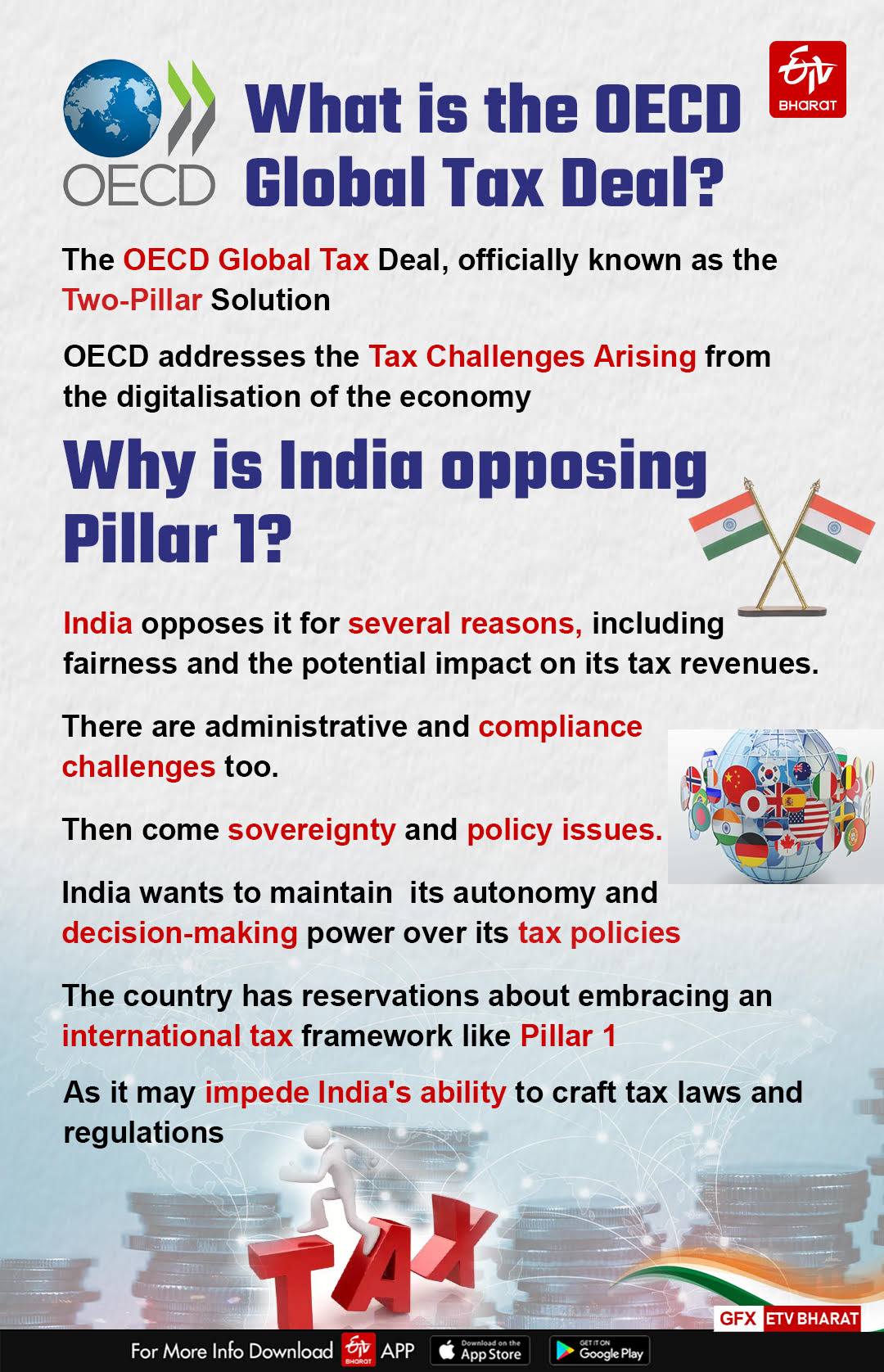

What is the OECD Global Tax Deal?

The OECD Global Tax Deal, officially known as the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy, is an international tax reform initiative aimed at addressing the tax challenges posed by the digitalisation of the global economy and multinational enterprises (MNEs).

The implementation of the OECD Global Tax Deal is expected to be a multi-year process, with various legislative and administrative challenges to overcome.

The key challenges are reaching a consensus on the technical details and implementation mechanisms among the participating jurisdictions, amending domestic tax laws and international tax treaties to align with the new rules, addressing potential disputes and legal challenges from affected MNEs, and ensuring effective coordination and information sharing among tax authorities.

Despite the challenges, the OECD Global Tax Deal represents a significant step towards modernising the international tax system and addressing the tax challenges posed by the digital economy and globalisation.

What does Pillar 1 of the OECD Global Tax Deal entail?

The OECD’s Inclusive Framework on Base Erosion and Profit Shifting (BEPS) introduced the Global Tax Deal to address the tax challenges arising from the digitalisation and globalisation of the economy. This comprehensive agreement is structured into two main components: Pillar 1 and Pillar 2. Pillar 1 specifically focuses on the reallocation of taxing rights and aims to ensure that multinational enterprises (MNEs) pay taxes where they conduct significant business and generate profits, rather than solely where they are headquartered.

Pillar 1 aims to address the following key issues:

Taxation of the digital economy: With the rise of digital services and global businesses, traditional tax rules based on physical presence are increasingly ineffective.

Fair distribution of tax revenues: Ensuring that market jurisdictions (countries where consumers are located) get a fair share of tax revenues from MNEs.

Reducing profit shifting: Limiting the ability of MNEs to shift profits to low-tax jurisdictions.

Why is India opposing Pillar 1?

India has expressed opposition to Pillar 1 of the OECD Global Tax Deal for several reasons, rooted in its concerns about fairness, equity and the potential impact on its tax revenues.

New Delhi believes that the current formula for reallocating profits under Pillar 1 favours developed countries where large MNEs are headquartered, rather than developing countries where significant economic activities and consumer markets exist. India argues that the allocation rules should more equitably reflect the contributions of market jurisdictions to the global profits of MNEs.

The high revenue and profitability thresholds (20 billion euros in global revenues and profitability above 10 per cent) mean that only a limited number of MNEs will be subject to the new rules. India contends that this narrow scope excludes many companies that generate substantial revenues from digital and consumer-facing activities within its borders.

India also has fears that the reallocation of taxing rights under Pillar 1 could lead to a significant loss of tax revenue. New Delhi is concerned that the proposed rules will reduce its ability to tax the profits of MNEs that derive substantial income from the Indian market.

Meanwhile, India has also implemented its own Digital Services Tax (DST), which imposes a levy on the revenues of foreign digital companies operating in India. Pillar 1 would require the removal of such measures, potentially leading to revenue losses that are not adequately compensated by the new allocation rules.

There are administrative and compliance challenges too

Implementing the new nexus and profit allocation rules under Pillar 1 will require significant administrative efforts and resources. India is concerned about the complexities involved in adapting its tax administration to comply with the new multilateral framework.

New Delhi has reservations about the effectiveness and fairness of the proposed dispute resolution mechanisms. It is worried that these mechanisms may favour developed countries and large MNEs, potentially putting India at a disadvantage in resolving tax disputes.

Then come sovereignty and policy issues.

India places great importance on maintaining its autonomy and decision-making power over its own tax policies. The country has reservations about fully embracing an international tax framework like Pillar 1, as it may impede India's ability to craft tax laws and regulations that are optimally suited to its unique economic situation and developmental objectives. There are concerns that the Pillar 1 rules could limit the flexibility India currently has to mould its tax system in a way that best serves its national interests and policy priorities.

New Delhi also has concerns that agreeing to Pillar 1 could restrict its manoeuvring room for future tax policy changes. There is a worry that accepting the Pillar 1 framework may be viewed as a compromise that weakens India’s negotiating leverage in other international tax discussions and reform efforts. By ceding some tax sovereignty now, India fears it could undermine its bargaining position and ability to defend its national interests when negotiating other global tax rules and standards going forward.

To sum it up, India’s resistance to Pillar 1 of the OECD’s Global Tax Deal arises from a confluence of factors related to fairness, economic impacts, implementation difficulties, preserving national sovereignty, and broader geopolitical strategy. Although India recognises the necessity of revamping international tax rules to account for the digital economy, it advocates for an approach that more equitably reallocates taxing rights and better aligns with the priorities of developing nations.

India’s position underscores the intricate challenges and inherent tensions involved in reaching a truly global consensus on tax matters, especially amidst rapidly shifting economic realities. The complexities stem from balancing diverse national interests while striving for a cohesive, modernised tax framework that can be embraced by all countries.

Read more: India Among Fastest Growing Economies In Asia Amid Global Slowdown: OECD