Kolkata: The West Bengal Budget proposal for the financial year 2021-22 was tabled in the state assembly on Wednesday. In the wake of the COVID-19 situation, the Mamata Banerjee-led state government announced some major relief in road tax and stamp duty in the budget proposals.

In absence of the state Finance minister, Dr Amit Mitra, the state’s legislative affairs and commerce and industries minister, Partha Chattopadhyay read out the budget proposals on Wednesday. He tabled a Rs 3.08 lakh crore budget on Wednesday. Interestingly an amount of Rs 1.29 lakh crore was allocated for the industries and commerce department for the fiscal under view.

Read:| BJP MP quits as BJYM's Bengal chief, slams Adhikari for 'misleading central leaders'

Economic and industry observers feel that this is a good signal and it proves that besides welfare activities, the state government has also started concentrating on industrial development in the state. At the same time, Rs 21.71 crore was allotted for backward class development and Rs 500 crore for the student credit card scheme. Commenting on the road tax waiver, Chattopadhyay said that the waiver which was supposed to end on July 1, 2021, has been extended till December 31, 2021.

At the same time, a two per cent reduction in stamp duty on property deed registration was also announced. The circle rate was also reduced by 10 percentage points. In his budget speech, Chattopadhyay launched a scathing attack against the Central government on the rising fuel price.

Read:| Is the Lotus wilting before blooming in Bengal?

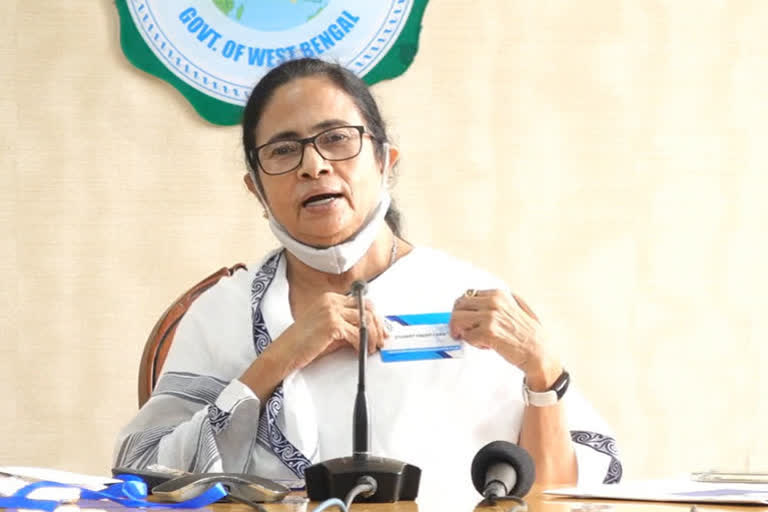

After the budget proposal was tabled, the Chief Minister met the media persons where she said that this budget fulfils the expectations of the people. “At the time, when the nation’s economy had nosedived, West Bengal’s gross state domestic product had increased by 1.2 per cent. People will have to be provided with money and only then the demand for products will rise,” she said.

Speaking on the occasion, the Chief Minister also said that massive investment to the tune of Rs 72,00 crore is on the cards at Raghunathpur in Purulia district. She also claimed that Silicon Valley has already attracted investment to the tune of over Rs 1,000 crore.

She once again attacked the Centre on the issue of devolution of the state’s share in GST. “We are yet to receive around Rs 60,000 crore from the Central government on this count. The figure was Rs 58,952 crore in 2020-21, of which we received just Rs 44,737 crore,” the Chief Minister said.