New Delhi: Telangana chief minister K Chandrashekar Rao triggered a debate over a five-decade-old policy prescription when he reportedly asked the RBI to adopt the policy of ‘Helicopter Money’ for the revival of Indian economy which is likely to suffer a massive setback due to the outbreak of coronavirus.

The term ‘Helicopter Money’ was first used by the economist Milton Friedman in 1968, who suggested it as a last resort to stimulate an economy that is in the grip of deflation. Deflation is a situation of a general decline in the prices of goods & services due to a shortage of money.

So what is Helicopter Money and can RBI pump in or print a lot of currency and circulate them in the system? ETV Bharat’s Krishnanand Tripathi spoke to R Gandhi, former Deputy Governor of Reserve Bank of India to find out the answers.

What is Helicopter Money?

“Helicopter Money is typically used to describe government spending in a big way in social welfare measures and across the economy. When it is distributed in a wide manner across several sectors, it is called Helicopter Money,” said R Gandhi.

Former US Fed Chairman Ben Bernanke was also considered a proponent of this policy. His support of the policy earned him the nickname of Helicopter Ben.

“Typically, this word is not used for a Central Bank. For a Central Bank, Quantitative Easing (QE) is the standard terminology. It means that the Central Bank should be buying assets, bonds, and government securities in a big way to pump more money into the economy,” said R Gandhi who was Deputy Governor of RBI between 2014 to 2017.

What kind of economic package KCR is looking for?

Telangana chief minister K Chandrashekar Rao asked for a fiscal stimulus package to the tune of 5% of the country’s GDP, which has been pegged a little over Rs 200 lakh crore and a package of 5% means a stimulus package of Rs 10 lakh crore.

Some other leaders have even asked for a bigger package, 10-12% of the GDP, taking the total size of the package to over Rs 20-24 lakh crore. Whereas in the first round, finance minister Nirmala Sitharaman had last month announced the PM Garib Kalyan Package of Rs 1.7 lakh crore, which also covered several existing schemes like transfers under PM Kisan Samman Nidhi to farmers.

States like Telangana, Andhra Pradesh, Kerala asked more support, especially for farmers and increased allocation for NREGA.

How does RBI create money in the system?

R Gandhi explains whenever Central Banks do Quantitative Easing, they create money in the system but it is much more than printing currency in physical form.

“Whenever RBI creates money in the system then only one-sixth of that money is printed in form of currency notes, and nearly five-sixth is in form of entries in the books of accounts,” he told ETV Bharat.

So how the currency is printed and circulated?

“RBI or any other Central Bank, they print a lot of currency and they keep it in stock and whenever a part of economy or segment wants physical cash, the Bank provides the cash,” said R Gandhi who was in-charge of currency and debt management division of the Reserve Bank.

How does RBI decide the quantum of currency to be printed?

Another former officer of the RBI told ETV Bharat that the RBI makes an assessment of projected GDP growth and then takes into account the cash-to-GDP ratio to decide the quantum of money to be printed.

How much currency is there in the system?

In March 2020, the total currency available in the system was pegged at Rs 24.39 lakh crores, little over 12% of the GDP for FY 2019-20 at Rs 204 lakh crore.

In the Union Budget, finance minister Nirmala Sitharaman projected 10% nominal GDP growth in FY 2020-21, taking the total size of GDP by the end of this fiscal to Rs 225 lakh crores.

According to former RBI officials, the Bank will take into account several factors like the trend and growth in digital payments, use of cash, government policies and several other factors while deciding to print or release new currency in the system.

Read more:Economic cost of lockdown is nothing compared to people's lives: PM Modi

However, the cash-to-GDP ratio has seen a steady rise in the last three years. It had declined sharply to 8.69% in March 2017 due to demonetization exercise conducted in November 2016.

However, the cash-to-GDP ratio rose to 10.7% in March 2018 and 11.23% in March 2019, finally reaching over 12.2% at the end of March 2020.

Can the RBI print a lot of currency at will?

Some people may assume that the Union government or RBI can print a lot of currency and bring it in the circulation. However, this is not how the system works in real life.

For example, several Latin American and African countries faced high inflation and a steep devaluation of their currency when they created excess money in the system.

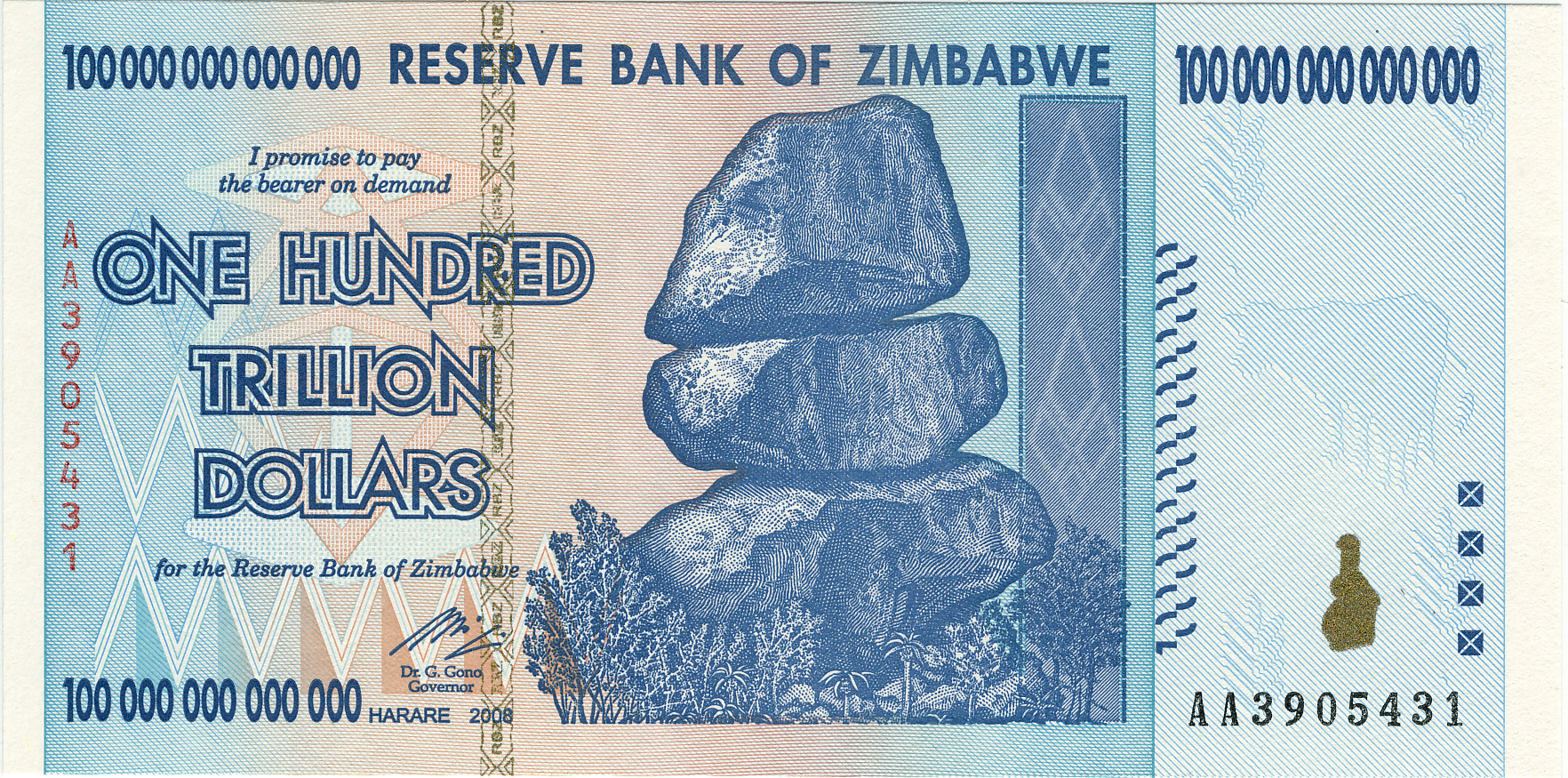

Example of Zimbabwe

In Zimbabwe, the government printed a lot of currency between 2007-2009, leading to astronomical fall in the value of the country’s currency and creating a situation of hyperinflation.

In fact, Zimbabwe’s currency was devalued so much that it had to print a 100 trillion Zimbabwean Dollar note, which was once exchanged for just 40 US Cents.

“The Zimbabwe government just printed hoards of currency without any revenue receipts, it completely eroded the value of their currency,” the former RBI officer cited above told ETV Bharat.

“Even now US Dollar and other currencies are used in Zimbabwe including Indian Rupee,” he added.

Countries following a loose money policy experienced high inflation

“Zimbabwe is the worst case but other similar bad examples are there in the world,” said R Gandhi in response to a question about Zimbabwe.

“Several examples are there, several Latin American Countries and many African countries ran into 200-300% or even 500% inflation when they created money in the past. They suffered this kind of hyperinflation and devaluation of their currencies,” he said.

How does RBI strike a balance between growth & inflation?

“Whenever a Central Bank increases the money supply, it leads to inflation that is why Central Banks do not create money easily even though politicians and people suggest like this,” observed R Gandhi while talking about the dilemma faced by Central Banks when they need to choose between propelling growth and controlling inflation.

Economists say that the creation of excess money simply means that more money will be chasing fewer goods thereby raising the prices of the same goods.

“Reserve Bank will factor in as to what extent it will lead to inflation and whether it is manageable or not? If it is manageable only then the Reserve Bank will undertake the creation of money. If it is projected that it would lead to large-scale inflation then RBI will not do it,” explained R Gandhi.

Modern economies insulate monetary policy from executive influence

A transparent monetary policy is crucial for the stability of a country’s currency, inflation, employment and growth that is why most of the advanced economies have insulated the functions of Central Banks from political interference.

However, in their bid to pursue high economic growth, some governments try to persuade or goad their Central Banks to lower the benchmark interest rates or increase the money supply by cutting the amount of reserve money in the system.

In India, RBI governors and finance ministry have often been at odds over the issue of rate cuts.

Some people believe that the reason for the departure of two former Reserve Bank Governors, Raghuram Rajan and Urjit Patel, was that their policies were not in sync with the thinking of the government which expected the RBI to cut rates to fuel growth.

In March this year, the US President Trump publicly called the US Fed to cut the interest rate to zero or negative to spur the economic activity to refinance the country’s debt load.

Whether the money created by RBI is backed by assets?

In response to a question by ETV Bharat, R Gandhi clarified that if the RBI needs to issue additional physical currency notes, then it should have Government of India Security or Foreign Securities of corresponding value.

“When Reserve Bank creates money then it should always have assets against that. These assets are typically government of India securities and it will buy it from the market,” said the former Deputy Governor of the RBI.

Explaining the mechanism of printing the currency, the former banker said the Union government issues security to market that is then purchased by banks, LIC and other institutions that are in turn purchased by the RBI at a higher interest rate before printing the corresponding amount of currency.

How did Quantitative Easing work in foreign countries?

After the global financial crisis of 2007-08, the US and European Central Banks resorted to large-scale asset buying in their countries. The aim was to pump more money in the market to support economic activity.

Quantitative Easing in the US

Following the global financial crisis of 2008, the US Fed bought securities worth over $2 trillion, taking the total value of its balance sheet to $4.4 trillion in October 2014. It was the biggest stimulus in human history.

However, experts are divided over its efficacy, while IMF and some economists argued that the Quantitative Easing played a significant role in supporting the economy, former Fed Chair Alan Greenspan in 2012 had calculated that there was a ‘little impact’ on the economy.

Japan’s experience with Quantitative Easing

The world’s third-largest economy Japan has been in the grip of deflation for over two decades and the policies of Bank of Japan (BoJ) have not helped the country to come out of it despite having ‘zero’ interest rate policy.

“Japan's economy is a typical example of where people save a lot. It leads to deflation,” said R Gandhi.

“These things are relative, they have to be proportionate, excessive saving or expenditure, both are bad,” he observed.

(Article by Krishnanand Tripathi)