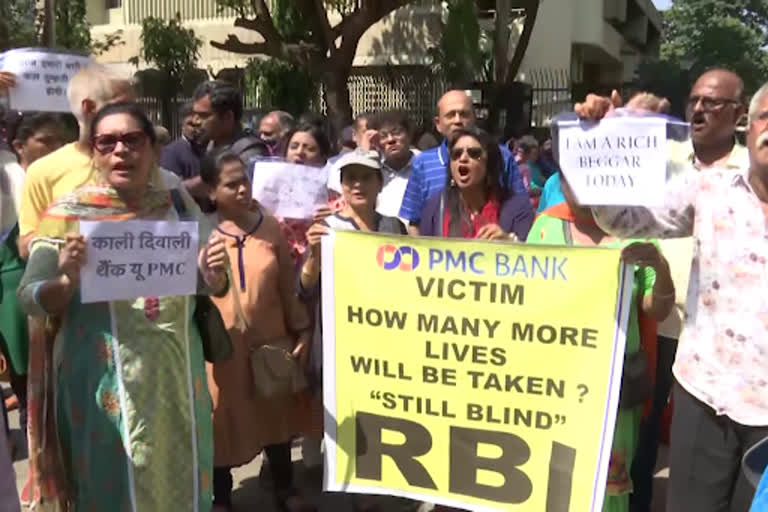

Mumbai: Harried depositors of the troubled Punjab and Maharashtra Cooperative (PMC) Bank continued with their protests by agitating outside an office of the Reserve Bank here on Tuesday, to demand a payback of their stuck money.

A depositors' delegation also met a Chief General Manager-rank officer after the protest in suburban Bandra Kurla Complex (BKC) and submitted a memorandum.

The PMC Bank has been put under restrictions by the RBI for over a month, after an alleged Rs 4,355 crore scam came to the light following which the deposit withdrawal was initially capped at Rs 1,000, causing panic and distress among depositors. The withdrawal limit has been raised in a staggered manner to Rs 40,000.

At least five depositors, who had a high quantum of money stuck with the bank, died in the last month, including one who committed suicide.

The depositors, majority of the senior citizens and women gathered at the RBI building which houses the offices of the chief general manager for cooperative banking regulation, with banners like it being a "Black Diwali" because of the PMC crisis.

Later, a five-member delegation went to meet senior RBI officials and submitted a memorandum.

After its meeting with RBI officials, Jitshu Seth, one of the delegation members, said they requested the RBI to assure them that their money lying with the trouble-hit bank was safe.

"The RBI official said their priority is to protect the money of each and every depositor," she said, adding that the RBI was also been urged to either arrange a Rs 4,000 crore infusion into the bank or merge it with a healthy lender.

Another delegation member Harbans Singh said he will be filing a writ petition in the court seeking payback for depositors by selling property worth over Rs 4,000 crore attached by the investigating agencies.

Depositor Satish Thapar, who was among the protesters, said the bank can be revived because the probing agency has attached more assets of the accused than the loans given.

"The bank has become a sinking ship now, but we want that it should be restarted immediately," he said.

He said the depositors' current and savings accounts with the PMC Bank should be activated with immediate effect so that "they can have their bread and butter".

Meanwhile, one of the depositors from suburban Mulund, where the bank has the maximum presence, alleged that he was detained by the city police ahead of the planned protest on Tuesday outside the RBI office.

The depositor said this was done as a preventive measure and a message was passed, asking the depositors to protest at south Mumbai's Azad Maidan, the financial capital's officially designated protest ground.

The depositors have so far held over two dozen protest since the bank was put under directions by the RBI, and have agitated outside the RBI's headquarters and also the official residence of Maharashtra's chief minister.

They also targeted political campaign venues ahead of the elections to the state, which resulted in them getting an audience with Finance Minister Nirmala Sitharaman as well.

The crisis at the bank is attributed to loans made to realty player Housing Development Infrastructure Ltd (HDIL), which were allegedly hidden from regulators' scrutiny, turning non-performing assets.

Five persons, including HDIL promoters and bank's top management, have been arrested.

The Enforcement Directorate is also investigating the case and has attached the assets of HDIL promoters, Rakesh Wadhawan and his son Sarand Wadhawan, who are in its custody.

Over Rs, 6,500 crore of the bank's advances of Rs 9,000 crore was made to either HDIL or dummy companies affiliated to it, which have gone sour.

The bank has deposits of over Rs 11,000 crore and the RBI has said that 77 per cent of the depositors can withdraw their money with the Rs 40,000 limit.

The administrator put by RBI to oversee the bank's operations is presently restating the books to present a fair picture of its financial strength.

Read more: Ambani says slowdown in India temporary, reforms undertaken to reverse trend