Hyderabad: The 16th Finance Commission, a constitutional body, is expected to be constituted in late November 2023. It will be constituted by the President Droupadi Murmu under Article 280. The purpose of the commission is to give recommendation on distribution of net tax avenues under chapter of the constitution. The terms of reference established by the Ministry of Finance for a certain five-year period are used by the Commission to distribute tax profits. The 16th Finance Commission's proposals are going to be in effect from April 2026 to March 2031.

1. Terms of Reference (TOR) and Additional TOR: The Presidential order clearly states the Terms of Reference (ToR) for the FC. Apart from the core objectives, the TOR may ask the commission to analyse various macro-fiscal issues. For example, The 13th FC was asked specifically to analyse and review the state of the finances of the Union and the states and the operation of the states’ Debt Consolidation and Relief Facility (DCRF) 2005-10. As an additional ToR, the 13th FC was asked to propose a roadmap for fiscal adjustment through 2010-15. Some of the TOR related to 15th Commission became controversial. One, using Population data of 2011 instead of 1971. Second, whether revenue deficit grants be provided. Third, whether a separate mechanism for setting up of a non-lapsable fund for defence and internal security.

2. Inter-governmental Fiscal Transfers (IGTs): The Administrative Reforms Commission (ARC) (1969) highlighted the overlapping functions between the Finance Commission and the Planning Commission. ARC recommended that the Finance Commission should deal only with the sharing and distribution of divisible central taxes and the Planning Commission should determine plan as well as non-plan grants. Further, for effective coordination, a member of the Planning Commission may be appointed to the Finance Commission. So, from the Sixth Finance Commission, one of the members of the Planning Commission was appointed as a member of the Finance Commission. Recently, there are major changes in the Inter-governmental Fiscal Transfers system in India. There were two main channels through which the funds flow to the states. FC transfers and grants given by the ministries. Earlier a significant part of IGTs for state plans were channelled through the Planning Commission of India. Since 2015-16, this route has been subsumed within the FC with the dissolution of the Planning Commission. Under the Non-FC channel, the transfers under Central Sector (CS) and Centrally Sponsored Schemes (CSS) are dispensed under Article 282 of the Constitution.

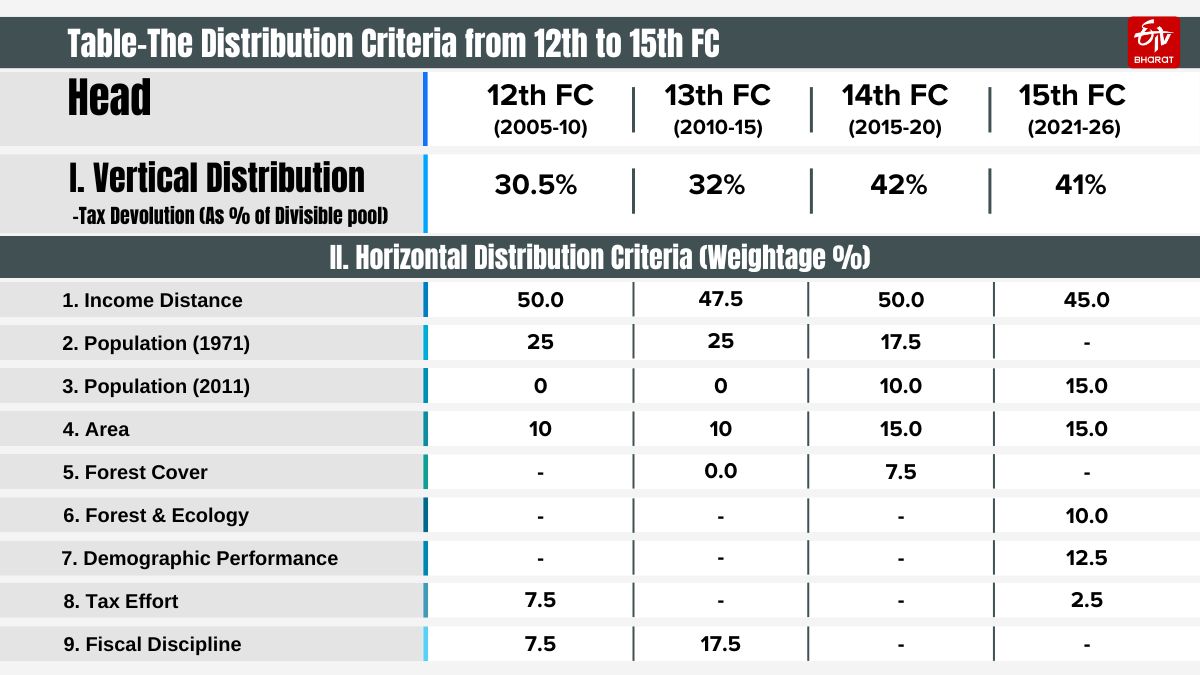

3. The vertical distribution: In India, there has been a historically high degree of vertical imbalance between the Centre and the states. This is largely due to constitutional division of powers on revenues and expenditure responsibilities. The 11th finance commission corrected major leakages by bringing all the taxes under the devisable pool. But, Recently, there has also been an increase in the size of the non-shareable portion of central revenue receipts in the form of cesses (15th FC study estimated it be around 10% of sharable tax proceeds). To that extent, this is a huge loss to the states, since cesses and surcharges do not form part of the divisible pool. This is against the spirit of fiscal federalism. The 12th Finance Commission had raised the share of States in the divisible pool of central taxes to 30.5% from 29.3% in the 11th Finance Commission. Subsequently, 13th and 14th FC have raised the share to 32% and to 42% respectively. The 14th FC gave a big push primarily to accommodate and compensate the changes in inter-governmental transfers (abolition of planning commission and restructuring of CS and CSS schemes). The 15th FC revised it to 41% when the number of States in India was reduced to 28 (When J&K is turned into Union Territory). The 16th FC is expected to increase the share further to give additional resources to states, to adjust the GST compensation cess and due to leakages in the form of cesses.

Horizontal Distribution: The share of individual States in the Centre’s divisible pool of taxes is determined by a set of indicators. These indicators are given differential weightage depending on the Finance Commission objectives and aims. The table explains the indicators and weightages more clearly. The Income distance, population, area are used and given high weightage by every finance commission. The other indicators are like incentive-related factors such as forest cover and demographic change. 13th FC tried to be more inclusive and biased towards poor states. In their formula for horizontal devolution, fiscal discipline got a 17.5% weightage. This formula for the poor states computed after setting their tax effort at the average for the special category alone, in place of an all-state average. State governments are very critical on the indictors which go against their favour. For example, the richer States demand for a low weight to income distance. The use of Population data of 2011 instead of 1971 triggered a big debate during 15th FC tenure. The address concerns of good demographic states, the 15th FC introduced demographic performance (with weightage of 12.5%) as an indicator.

Special Purpose Grants: Generally, every finance commission award some special purpose grants to different sectors, especially, for equalisation of education and health. The 14th FC did not award any specific purpose grants, except for local bodies and disaster management grants. This is unlike the previous two FCs that had a far higher weightage on specific purpose grants. But, the 15th FC again, went back to the tradition of awarding specific purpose grants. We may expect the same in the 16th FC too. Revenue Deficit Grants: The revenue deficit grants are awarded to those states whose fiscal needs remain to meet even after maximising their own revenues and tax devolution due to some structural factors (cost disabilities and fiscal capabilities). These are not formula-based horizontal devolutions. The 14th FC, after taking into account of revenue gap, own revenue receipts, and tax devolution, awarded Rs. 194821 Crore as revenue deficit grants for eleven states during the award period 2015-16 to 2019-20. Andhra Pradesh awarded RD grants for all the years. Telangana did not get any RD grants, as it was not a revenue deficit state. The 15th FC recommended revenue deficit grants of Rs. 294514 Crore for seventeen States during the award period 2021-22 to 2025-26. Andhra Pradesh is awarded RD grants of Rs. 30497 crore only up to 2023-24. Again, Telangana did not get any RD grants, as it is not considered as a fiscally dependent state.

Debt-Deficits: The 15th FC report, after considering the pandemic impact on the state’s fiscal balances, recommended relaxations in state borrowing limits. The nominal net borrowing limit has been fixed at 4% of GSDP for 2021-22, 3.5% for 2022-23 and 3% for 2023-24 to 2025-26. In addition, 0.5% additional borrowing is allowed for power distribution sector reforms for 2021-22 to 2024-25. The 15th FC also recommended that “If a State is not able to fully utilise its sanctioned borrowing limit, as specified above, in any particular year during the first four years of our award period (2021-22 to 2024-25), it will have the option of availing this unutilised borrowing amount in any of the subsequent years within our award period.” Hopefully, The 16 th FC will also continue the fiscal consolidation and also put some restrictions on the Union government debt and deficit targets.

Challenges and Reforms: The Sixteenth Finance Commission can examine be blow issues.

1. Dr. C. Rangarajan and D.K. Srivastava suggest to set up a “loan council”, as recommended by the Twelfth Finance Commission. This independent body should oversee the loan magnitudes and profiles of the central and State governments.

2. Rationalisation of Expenditure and subsidies: All the finance commissions found that Interest payments, subsidies, and pensions are major components that drive expenditure at both Union and State levels. The 16th Finance Commission should be strict about States maintaining fiscal deficit within limits and look at the possibility of forming rules to rationalise subsidies. Commission should also take a stand and comment on the old pension vs new pension debate.

3. The setting up of Fiscal Council: There is a demand to establish “Fiscal council”, to improve accountability and efficiency of government finances. The 13th and 15th Finance Commissions and FRBM review committee also proposed this idea. These are called by various names such as the Congressional Budget Office in the United States, Parliamentary Budget Office in Australia and Canada, Office for Budget Responsibility in the United Kingdom, Public Finance Council in Portugal, Fiscal Advisory Council in Ireland and Fiscal Councils in most other countries.

4. Off-budget borrowings: The states are now resorting to aggressive off budget borrowings. The 16th FC may come up with some restrictions on the off-budget borrowings.