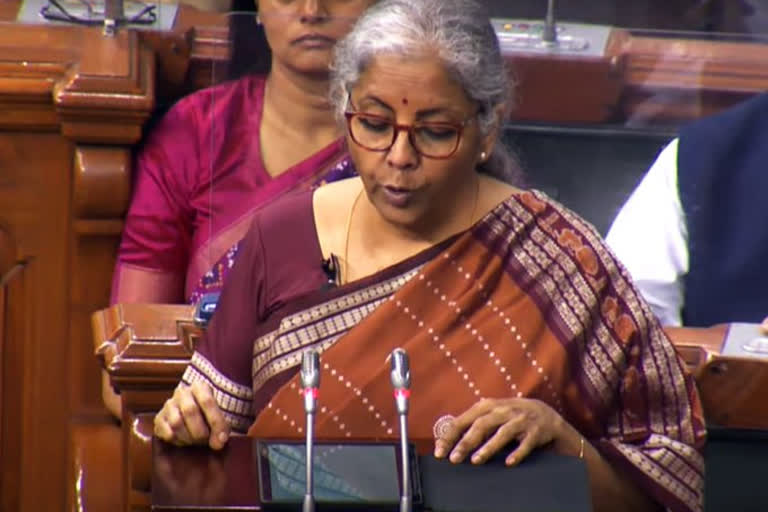

New Delhi: While announcing the decision to introduce a digital rupee, Finance Minister Nirmala Sitharaman said that "Crypto is not a currency". Many must have been confused by the statement. In this context, let us understand what Central Bank Digital Currency (CBDC) is, why RBI is launching it, and how it is different from Cryptocurrencies.

What is a CBDC?

A CBDC is a legal tender in digital form, issued by a central bank. It works just like traditional money, but it is digital. All fiat money like paper bills and coins, as well as checks, securities, and bonds, can be treated as CBDC. Supposedly, you can use a CBDC to pay for goods and services and make other monetary transactions. Its only difference is the form. Simply put, it is like holding Rs 100 worth of physical cash, but in your digital wallet that is installed on your smartphone.

Why would the RBI launch its own digital currency?

India is known as one of the leading countries in terms of digital payment innovations. The country facilitates payments that can be processed instantly almost anytime with minimal fees. This is probably why many multinational companies operating in India are now accepting digital currency payments. RBI, faced with dwindling usage of paper currency, seeks to popularize a more acceptable electronic form of currency.

Difference between CBDC and Cryptocurrency?

Transactions and issuance of the CBDC currency will go through a government review and approval process. Limits and distribution of CBDCs will depend on RBI. It will also be in charge of producing new digital coins, as and when need arises. Unlike cryptocurrency, CBDC promises less volatility and greater security. Only way to get CBDC is through central banks, and in the form of digital legal tenders.

Cryptocurrencies like Bitcoin, on the other hand, are not governed by any central authority. Since it has no central authority, no one can change its maximum price, unless the protocol is altered, which is very unlikely. Bitcoin serves as an asset or a commodity that can be bought and sold on marketplaces such as Paxful and cryptocurrency exchanges.

Benefits of Digital rupee in the Indian context

With the introduction of CBDC, India could reduce the economy’s reliance on cash. This will then enable cheaper, faster, and more convenient international payments and transactions. Additionally, it is believed to potentially promote more real-time and cost-effective globalization of payment systems. Apart from building a cashless economy, CBDC is also considered an instrument in promoting financial inclusivity and modernizing the current banking sector of India.

Countries that have launched CBDCs

The Central Bank of the Bahamas has officially launched its national digital currency in October 2020.The first of its kind in the world to have been fully deployed, the sand dollar is a digital version of the Bahamian dollar. Bahamas central bank said it wants to eliminate the use of checks in the country by 2024 because, in its view, mobile wallet payments and the sand dollar are better alternatives for consumers. Similarly, the Central Bank of Nigeria (CBN) officially launched the “eNaira" on October 25, 2021.