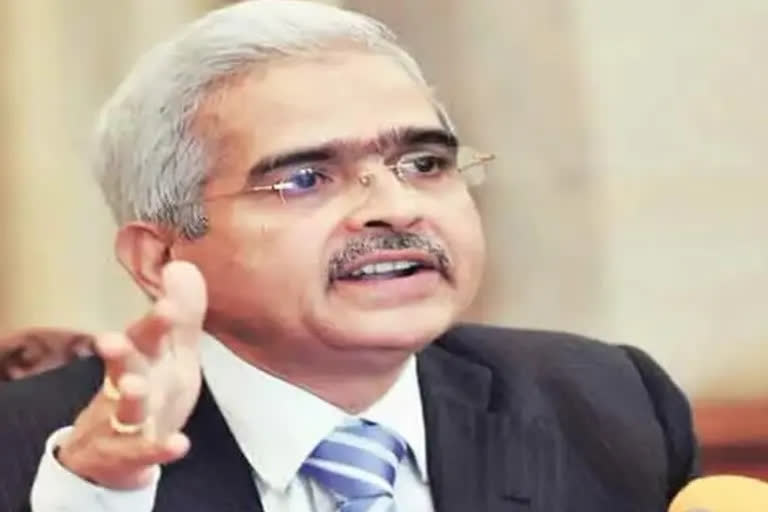

Mumbai: India is much different today than what it was earlier and the developed world needs to trust the credibility and strength of local regulators, RBI Governor Shaktikanta Das said on Wednesday. In comments that come in the wake of the European Securities and Markets Authority (ESMA) and the UK derecognising Indian clearing houses, Das said Indian market infrastructure complies with all the international standards.

"I think, it is also necessary for regulators on the other side to appreciate the credibility, they must trust the credibility and strength of the Indian regulations. That is what we are trying to impress upon them," Das told reporters here. India is different from what it was 10-20-30 years ago and the regulations here are robust, the governor added.

It can be noted that recently, the ESMA announced that it will stop recognising six major clearing houses from April 1 next year, which was followed by a similar move from the Bank of England. As per experts, such moves have the potential for disruptions as European lenders will be forced to set aside higher capital if they wish to continue dealing with non-recognized entities.

RBI Deputy Governor T Rabi Sankar, who had earlier termed the move by the European regulators as an 'unfortunate interference', on Wednesday explained that discussions are on in the matter and the Reserve Bank of India hopes to reach an understanding. "The fundamental point of divergence remains the fact that an Indian entity that does not operate in the European Union and operates entirely in India is being subjected to regulation by an EU regulator. This holds good for a few others as well," Sankar said, without divulging any exact details.

Once there is an agreement on the fundamental point of disagreement, we will be able to sort out the details, he added. Das also said that the RBI is hopeful of a resolution on the matter. The DG cited the case of Japan, which reached an agreement with India after assessing that the Indian financial landscape is "good enough".

He, however, added that if there is any disturbance because of the moves, the RBI is well prepared to handle the same. "We are fully compliant with the CPMI (Committee on Payments and Market Infrastructures) guidelines under the aegis of the Basel framework. And, we comply with all the CPMI standards. We comply with all the international standards. Our market infrastructure is very robust," Das said.

Resident entities from India will now be permitted to hedge gold price risks at the International Financial Services Centre, RBI Governor Shaktikanta Das said. At present, resident entities in India are not permitted to hedge their exposure to gold price risk in overseas markets. "With a view to providing greater flexibility to these entities to hedge the price risk of their gold exposures efficiently, it has been decided to permit resident entities to hedge their gold price risk on recognised exchanges in the IFSC," Das said after announcing the bi-monthly policy review.

The detailed instructions on the same will be issued separately by the central bank, he added. Meanwhile, Das also announced to extend the dispensation of enhanced HTM (held to maturity) limit of 23 per cent up to March 31, 2024, and allow banks to include securities acquired between September 1, 2020, and March 31, 2024, in the enhanced HTM limit.

The Reserve Bank had increased the limits under the HTM category from 19.5 per cent to 23 per cent of net demand and time liabilities (NDTL) in respect of statutory liquidity ratio (SLR) eligible securities acquired on or after September 1, 2020, up to March 31, 2023. This dispensation of enhancement in HTM limit was made available up to March 31, 2023, he said, adding that HTM limits would now be restored from 23 per cent to 19.5 per cent in a phased manner starting from the quarter ending June 30, 2024. (PTI)