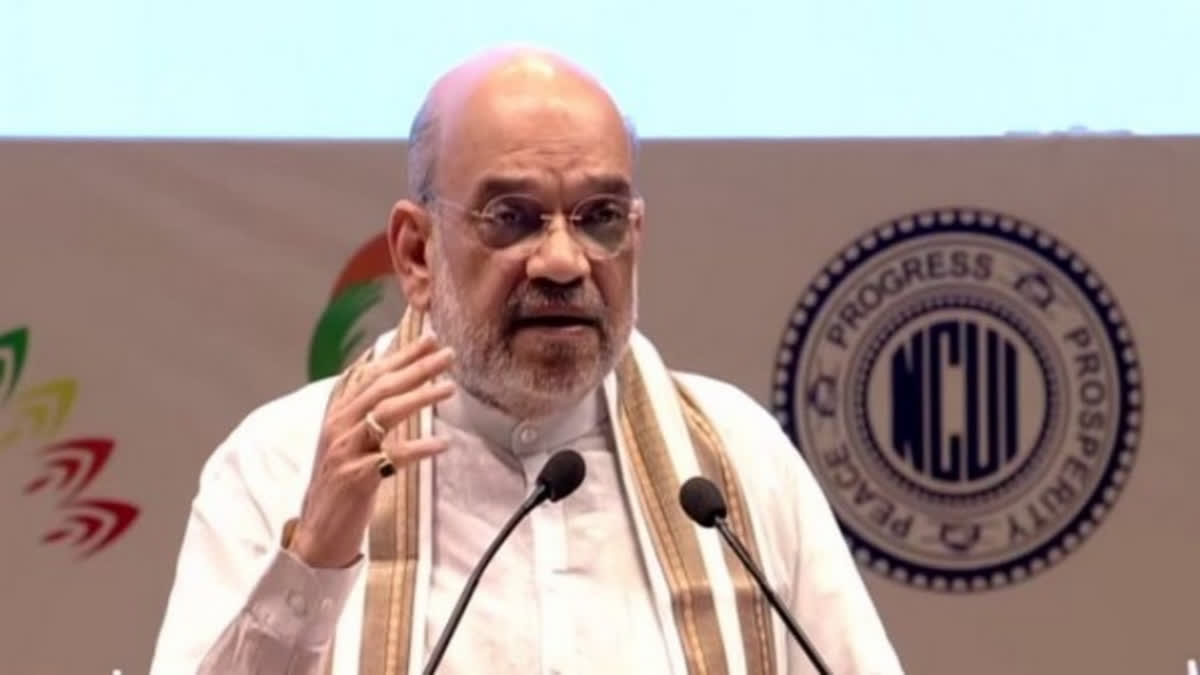

New Delhi: Minister of Cooperation Amit Shah on Wednesday said the government is working on the vision of 'Cooperation Among Cooperatives' for achieving faster rural development in the country.

Addressing the 42nd Foundation Day event of National Bank for Agriculture and Rural Development (Nabard), Shah said although the government has not announced, work is on. Cooperation among cooperatives would help in achieving better efficiency and improving income of rural population, he said.

"If we move ahead with the concept of 'Cooperation among Cooperatives' in the cooperative system of the country and if the entire money from PACS to APACS remains within its fold, then the cooperative system will require no money from anybody," he said. During the occasion, he launched the pilot programme for distribution of Rupay credit card by District Central Co-operative Banks (DCCBs) in the two districts of Gujarat. Panchmahal and Banaskantha are chosen as model districts for this project.

DCCBs are only allowed to issue Rupay debit card. There are about 8.5 lakh cooperative societies in the country, out of which there are 1.78 lakh different types of credit societies. In the field of agricultural credit, there are 34 state cooperative banks with more than 2,000 branches, 351 district cooperative banks with 14,000 branches and about 95,000 Primary Agricultural Credit Societies (PACS).

Narrating a story, he said, a women milk producer has written a story saying that money charged by credit card issuers are as high as 30 per cent and their DCCBs are not providing credit card. He said he checked with official and found it to be true and the idea of credit card by DCCB came from there.

With the pilot project roll-out, Shah said within days 5 lakh new accounts have been opened, 2,038 micro ATMs have become operative and about Rs 2,000 crore low cost deposits have been mobilised. Between 2014 and 2023, he said, the government under Prime Minister Narendra Modi have taken many initiatives for rural development, poverty alleviation and agriculture sector development.

The period of 9 years, from 2014 to 2023, is historic across many fields especially in eradication of poverty and development of agriculture, he said, adding, whenever the history of the country will be written, the 9 years governance of Prime Minister Narendra Modi will be etched in golden letters as many initiatives were undertaken in these nine years to eradicate poverty and strengthen the agriculture system.

Recognising the importance of cooperative sector, the Union government created Ministry of Cooperation with a view to achieve faster poverty alleviation target. The government has set up the ministry to help improve the income of 60 crore people of rural India. "Due to lack of timely changes in the laws, our cooperative system had deteriorated over time as it could not synchronize itself with the modern changes taking place in the society and the field of finance," he said.

On the various measures taken by the government for strengthening of cooperative, Shah said the government has undertaken the computerisation programme of all PACS in the country. This will be done in one year and this will help these entities become online and auditing would be online and credit would be distributed online.

To make PACS viable, he said, these entities would be made multi-dimensional. Now, PACS will also engage in the work of storage, open Jan Arogya Kendra, run Fertilizer shops, become part of PDS system, and will be provided the work of petrol pump and gas agency, he said. He said that three multi-state cooperative societies have been formed under the leadership of Prime Minister Modi.

Multi-State Cooperative Organic Society has been formed to ensure that farmers get fair prices for organic products in the global market, Multi-State Cooperative Export Cooperative Society has been formed to export our agricultural products to the world market and for the protection, promotion and development of our traditional seeds Multi-state Cooperative Seed Society has also been formed which will increase the production and marketing of high yielding seeds.

Shah asked Nabard to fix targets for financing agriculture sector and rural development for the next 25 years when India will complete 100 years of Independence. Observing that Nabard is not just a bank but a mission, he said, all employees of the organisation should be involved in fixing targets which should be reviewed every 5 years and the goals of 5 years should be reviewed every year.

He said that there is a need to come forward with courage and foresight to achieve the goals. Shah said Nabard, which is engaged in finance and refinance development activities in rural India, should fix its targets keeping in view its past performance and future requirements. He said that a nation with 65 per cent rural population cannot prosper without Nabard's initiatives.

"A stage has come today that we cannot imagine rural economy without Nabard," he said, highlighting the achievements of the organisation which played a key role in financing agriculture development and rural infrastructure. Nabard has worked as the backbone of this country's rural economy, infrastructure, agriculture, cooperative institutions and self-help groups of this country for last four decades, he said.

It has played a huge role in helping the self-help groups to stand on their feet which enabled every person of village especially mothers and sisters to become self-reliant and establish themselves in the society with respect, he said. Nabard came into existence on July 12, 1982 by transferring the agricultural credit functions of RBI and refinance functions of the then Agricultural Refinance and Development Corporation (ARDC).

In 1982, he said, the short-term loan of Rs 896 crore was provide for agriculture finance, which Nabard has taken to Rs 1.58 lakh crore today while long term agriculture loan increased to Rs 1 lakh crore as against Rs 2,300 crore. (PTI)