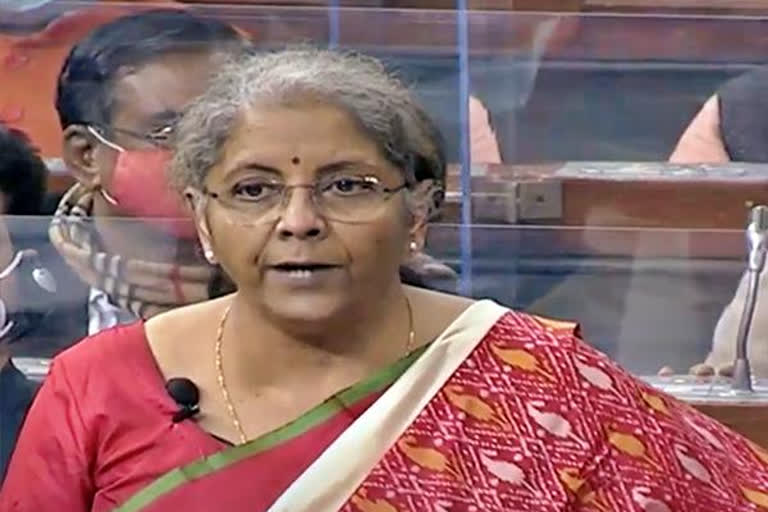

New Delhi: Following reports that funds of Indians in Swiss Banks have risen in 2021 as compared to 2020, Union Finance Minister Nirmala Sitharaman on Monday said in Lok Sabha that a number of concrete and proactive steps have been taken by the Central Government to bring to tax the undisclosed foreign assets and income in the recent past.

"However, certain recent media reports have stated that funds of Indians in Swiss Banks have risen in 2021 as compared to 2020. These media reports have also mentioned that these deposits do not indicate the quantum of the alleged black money held by Indians in Switzerland. A number of concrete and proactive steps have been taken by the Government to bring to tax the undisclosed foreign assets," stated Sitharaman in a written reply.

It has already been clarified by the Swiss authorities that the figures published by the Swiss National Bank (SNB) are regularly mentioned in the Indian media as a reliable indicator of the assets held with Swiss financial institutions in respect of Indian residents, she said.

"The media reports have not taken account of the way the figures have to be interpreted, which has resulted in misleading headlines and analyses. Moreover, it is frequently assumed that any assets held by Indian residents in Switzerland are undeclared (so-called ‘Black Money’),” she said.

Also read: Several supply-side measures taken in last 4 months to cool inflation: FM

The Swiss authorities had also conveyed that the SNB annual banking statistics should not be used for analyzing deposits held in Switzerland by residents of India. "Further, they have said that to analyze Indian residents’ deposits held in Switzerland, another data source should be used, which is called “locational banking statistics”, which the SNB collects in collaboration with the Bank for International Settlements (BIS)," said Sitharaman.

As of May 31, on account of deposits made in unreported foreign bank accounts in HSBC cases, so far, the undisclosed income of more than Rs 8468 crores has been brought to tax, and a penalty of more than Rs. 1294 crores levied.

Sitharaman said that 648 disclosures involving undisclosed foreign assets worth Rs 4164 crores were made in the one-time three months compliance window, which closed on 30th September 2015, under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. The amount collected by way of tax and penalty in such cases was about Rs 2476 crore.

Referring to the steps taken to bring back black money, Sitharaman said that the Government enacted a comprehensive and stringent new law, namely, the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 that has come into force from July 2015.

"Apart from prescribing stringent penal consequences, this law has included the offense of willful attempt to evade tax, etc. in relation to undisclosed foreign income/assets as a Scheduled Offence under the Prevention of Money Laundering Act, 2002 (PMLA)," Sitharaman said.

She said that for effective implementation of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, and efficient handling of the cases under this Act, 29 Foreign Assets Investigation Units have been set up under the Directors General of Income Tax (Investigation) all across India.

"The Government constituted the Special Investigation Team (SIT) on Black Money under Chairmanship and Vice-Chairmanship of two former Judges of Hon’ble Supreme Court in 2014. The meetings of the SIT are held regularly during which SIT is apprised of various actions against black money by various Government Agencies, particularly the cases involving undisclosed foreign assets and income," she said.

A Multi-Agency Group (MAG), consisting of representatives from various enforcement Agencies and Organizations, has been set up by the Government for expeditious & coordinated investigation of various categories of foreign asset cases like Panama paper leaks, and Paradise paper leaks, and the recent Pandora paper leaks, Sitharaman said.