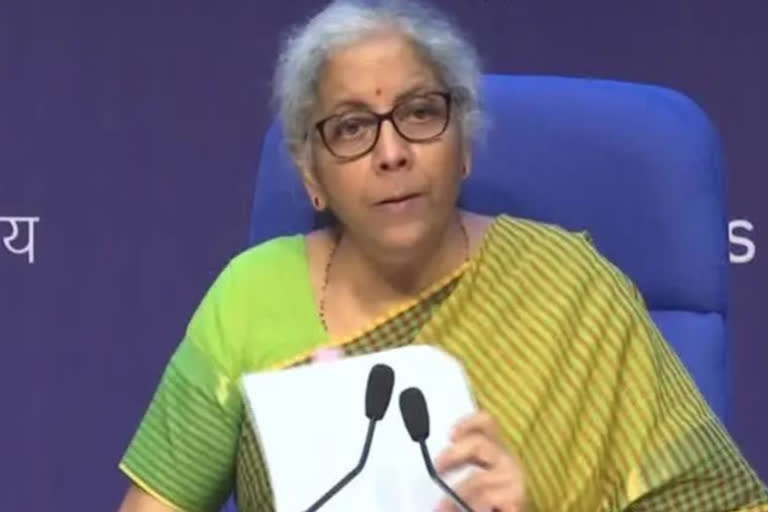

New Delhi: Finance Minister Nirmala Sitharaman said, global factors such as the Russia-Ukraine conflict, soaring crude oil prices and tightening of global financial conditions are the major reasons for the weakening of the Indian rupee against the US dollar, in a written reply to a Lok Sabha question.

Currencies such as the British pound, the Japanese yen and the euro have weakened more than the Indian rupee against the US dollar and, therefore, the Indian rupee has strengthened against these currencies in 2022, she said. The outflow of foreign portfolio capital is a major reason for the depreciation of the Indian rupee, she said.

Monetary tightening in advanced economies, particularly in the United States of America, tends to cause foreign investors to withdraw funds from emerging markets. Foreign portfolio investors have withdrawn about USD 14 billion from Indian equity markets in 2022-23 so far, the FM added.

On the impact of falling currency, she said, nominal exchange rate is only one of the factors that impact an economy. The depreciation of a currency is likely to enhance the export competitiveness, which in turn impacts the economy positively, while the depreciation also impacts the imports by making them more costly.

Also read: Rupee settles at 79.97 against US dollar; briefly touches 80/USD mark

The Reserve Bank of India (RBI) regularly monitors the foreign exchange market and intervenes in situations of excess volatility. It has raised interest rates in recent months that increase the attractiveness of holding Indian rupees for residents and non-residents. Earlier this month, the RBI raised the overseas borrowing limits for companies.

RBI also liberalised norms for foreign investments in government bonds as it announced a slew of measures to boost foreign exchange inflows. The RBI increased the ECB limit under the automatic route from USD 750 million or its equivalent per financial year to USD 1.5 billion, and eased norms for foreign portfolio investments in the debt market.

'Few states seek extension of GST compensation for 5 years'

The FM informed the Lok Sabha that a few states including Telangana have sought a five-year extension for the compensation paid to them for revenue shortfall due to GST implementation. When a nationwide GST subsumed 17 central and state levies from July 1, 2017, it was decided that states will be compensated for any loss of revenue from the new tax for five years, Nirmala said.

Also read: "Wake up PM, your prestige is at stake": Congress spokesperson over rupee fall

That timeframe has ended on June 30 this year. GST Council, in its 42nd meeting, has recommended extending the period of levy of GST Compensation cess beyond June 2022, she added. This was done to cover the entire shortfall as well as servicing the back-to-back loan released to states to meet their resource gap due to the short release of compensation, the Finance Minister said in a written reply to Lok Sabha.